Last Updated on February 7, 2025

In the last quarter of 2024, China’s economic growth witnessed a rapid increase in the GDP rate to around 5.4%, which is notably higher than the recorded data from the same period in 2023. Next to the US, the country held the second-largest economy in the world, with a value of $18.5 trillion.

China also has a dynamic digital ecosystem, which drives a significant portion of its economy’s rapid growth. With the world’s largest social media user base, foreign investors and businesses naturally see the country’s virtual landscape as a lucrative venture to explore.

If you’re interested in entering the market through local online channels, here’s a list of the top Chinese industries worth checking out.

How is China’s economy doing today?

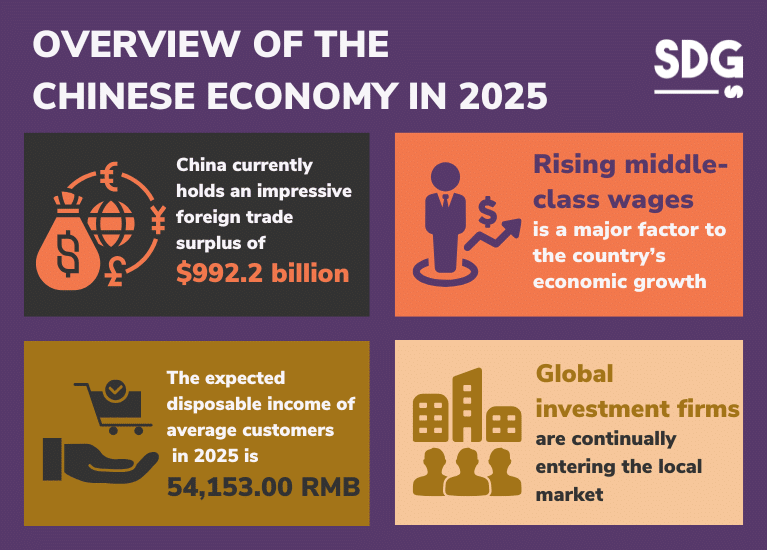

Beyond its GDP growth rate, China is a major global economic power with a foreign trade surplus of $992.2 billion. This year, industry revenue projections range from around 3% to 4%, which is a notable forecast compared to the market’s stagnant growth in 2023.

The growth of China’s economy can also be attributed to the rising wages of middle-class consumer groups. By the end of 2025, the disposable personal income of average local residents is expected to reach around 54,153.00 RMB.

This predicted increase shows the potential of the Chinese consumer market in the long run and, in turn, will bring more revenue to different top industries in China.

Foreign investment firms also drive the positive outlook for this year’s revenue growth. Recent reports suggest that this segment experienced an impressive rate of 6.2%.

What are the key industries in China today?

1. Health and Wellness

Although the worldwide pandemic is long over, the domestic consumption of wellness products and healthcare services seems to continue in the Chinese market beyond the regular demand.

Around 75% of consumers in this segment actively search China’s digital channels for information about these goods. The top sources of health information include short videos, local search engines, influencers, and social media.

With 87% of Chinese people considering health as the top priority in their lives, it’s no surprise that wellness trends like “light health” and “green foods” are infiltrating the local F&B industry.

KFC China offering “green foods” to health-conscious consumers (Source: China Daily)

Foreign and Chinese companies are still actively aligning their offerings with the ongoing demand for health and wellness trends. Most are localizing their products, incorporating beneficial health ingredients, low-calorie components, and dietary additives to appeal to Gen Z and Millennial consumer base.

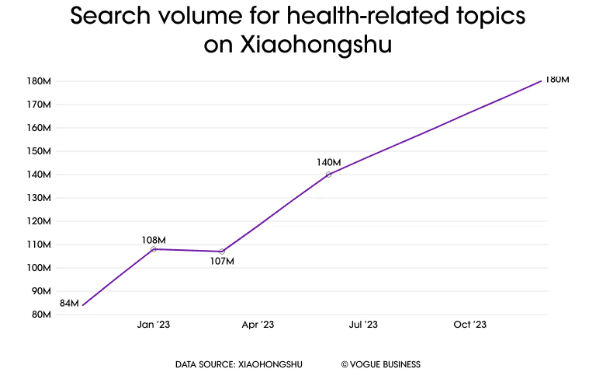

With the fast-paced industry development of China’s digital economy, it’s easy to track just how much modern consumers seek wellness products. For example, if you look at Xiaohongshu’s search volume data for 2023, you’ll notice that health-related tags generated over 180 million inquiries.

Given how Xiaohongshu is integrated with e-commerce features, these numbers indicate a high domestic demand for the health and wellness sector.

Health and Wellness Searches on Xiaohongshu (Source: Vogue Business)

2. Outbound Tourism and Hospitality

Around 130 million Chinese tourists traveled overseas in 2024, making outbound tourism and hospitality one of the major industries contributing to China’s potential economic growth in 2025.

Instead of traditional sightseeing in popular tourist spots and domestic city walking, younger Chinese travelers seek unique, personal experiences that resonate with the changing market trends.

Solo travel shows substantial growth, especially among affluent female travelers with growing financial independence. Beyond retail travel trips and seeking luxury goods, this consumer group views tourism as a reward for their achievements and hard work.

Source: Global Times

Last year’s outbound tourism also surged in Asian destinations like Thailand, Malaysia, Japan, and Singapore. The uptick in overseas travel often occurred during major Chinese festivals and celebrations, such as the Chinese New Year and October Golden Week (National Day).

During the May Day holidays in 2024, the Chinese OTA platform Qunar recorded record-high flight ticket bookings to nearly 100 overseas destinations. Because of this, industry experts and travel agents are optimistic that the industry will fully recover or exceed pre-pandemic levels in 2025.

With more countries offering visa-free policies for Chinese tourists, it’s clear as day that China’s outbound tourism market is set to contribute to the global economy in the long run.

3. Retail Sales and Live-Commerce

With Chinese government policies backing up cross-border e-commerce channels, foreign businesses can expect continued development in this sector. Today, online shopping accounts for 27.6% of the market’s overall retail sales volume.

In 2024, approximately 82.3% of the Chinese internet users surveyed by Statista admit to browsing and purchasing products online. This is a slight increase from the 82% penetration rate in 2023. The continued digitalization of the retail sales segment is expected to bring more industry revenue in 2025.

The live-streaming trend also seems to aid e-commerce’s continued domination of China’s digital landscape. In fact, over 75% of local internet users utilize these real-time video channels for their daily online shopping and entertainment needs.

By June 2024, the market generated over 12.34 million live-commerce hosts in China. This user base refers to individuals, influencers, professionals, and businesses using live-streaming services to promote their products in real time.

It’s an online selling format that combines influencer marketing with real-time content’s social element. The effectiveness of this strategy can be seen in the average live commerce per capita consumption, which ranges around 7,399.58 RMB.

4. Healthcare and Biotechnology

If you’re a foreign brand looking to enter the Chinese market, the healthcare and biotechnology sector is one of the first places to look. China’s population is aging, and the demand for better medical treatments and services has never been higher.

Individuals aged 60 and above constitute 20% of the Chinese population, and those over 65 comprise 15%. This demographic shift is expected to increase medical costs and strain the healthcare system.

Global Pharma, Sanofi, in China International Import Expo (Source: China Daily)

Because of this, the Chinese government further drives innovation in biotech research and product development by approving grants and favorable policies. This opens the door to many business opportunities, including telemedicine platforms, medical devices, pharmaceutical developments, and more.

In 2023, China’s biotechnology market generated revenues of approximately $74.16 billion and is projected to reach $262.96 billion by 2030. With more foreign investors pouring into this sector, industry revenue from healthcare and biotechnology will likely be critical to the growth of China’s GDP in 2025.

5. Investment and Financial Services Industry

In 2020, China removed foreign ownership limits in the securities, futures, and life insurance sectors, allowing full foreign ownership of these businesses. This policy permitted companies like JPMorgan and Goldman Sachs to take complete control of their Chinese operations.

Today, the financial services market in China is valued at approximately USD 2.8 trillion. Over the next five years, the market will grow at a compound annual growth rate (CAGR) of around 10%.

6. Entertainment and Digital Media

China’s entertainment and digital media landscape offers a dynamic arena for foreign brands, with sectors like streaming services, gaming, and digital content creation experiencing significant growth.

The online gaming market will particularly help China’s GDP in 2025, given that it has achieved a record revenue of approximately 325.8 billion yuan ($44.8 billion). This marks a 7.53% increase from the previous year.

Local gamers playing Honor of Kings by Tencent

The rise of micro-dramas, short-form video content tailored for mobile consumption, has also transformed the digital content landscape in China. In 2023, the revenue from micro-dramas in China reached 37.39 billion yuan ($5.31 billion).

The continued popularity of these entertainment trends presents unique opportunities for foreign brands to engage with Chinese audiences through innovative content formats.

7. Food and Beverages Industry

China’s food and beverage sector has notably increased at-home consumption, especially during the pandemic.

Growth in specific segments, such as instant noodles and frozen foods, may slow as dining out resumes. However, staples such as herbs, spices, and cooking oils are expected to maintain their growth trajectory.

There is a growing demand for high-quality, healthy, and safe food products. Chinese consumers are increasingly concerned about food safety and are willing to pay a premium for organic and imported food and beverages.

Convenience is a significant driver, with a preference for ready-to-eat meals, snacks, and beverages that fit busy urban lifestyles. This trend opens opportunities for foreign brands specializing in these market segments.

Chinese consumers looking at precooked dishes (Source: China Daily)

Top Challenges Foreign Businesses Might Face in the Chinese Market

● Regulatory Environment

The regulatory landscape in China is constantly evolving, making it challenging for businesses to stay compliant. Companies must follow cybersecurity, data protection, advertising restrictions, and foreign investment regulations.

Recent changes, such as the Personal Information Protection Law (PIPL) enacted in 2021, have also added complexity for companies handling data.

While the healthcare and medical sector is one of the top Chinese industries today, businesses offering these products and services may face even stricter scrutiny due to public safety and national security concerns.

The sector is regulated by bodies such as the National Medical Products Administration (NMPA), which imposes rigorous standards for product approvals and clinical trials.

For instance, foreign pharmaceutical companies often face longer timelines to gain regulatory clearance than domestic firms. Navigating this environment requires constant vigilance, in-depth legal counsel, and collaboration with local partners to ensure compliance and mitigate risks.

● Market Competition

China’s market is fiercely competitive, with both domestic and international players striving for market share. Local companies often have the advantage of better understanding the cultural and consumer nuances.

Many renowned global brands are also already utilizing cross-border e-commerce platforms to gain a foothold in the country’s digital landscape.

● Cultural Differences

Understanding and adapting to local cultural nuances is crucial for success in China. Marketing strategies that work in Western markets may not resonate with Chinese consumers.

For instance, their preference for mobile-first and social commerce experiences requires a more localized digital marketing approach.

Quick Q&A

What is the most profitable industry in China?

‘The industrial sector, which includes manufacturing, mining, and construction, is the most profitable in China. It accounts for about 31.7% of the country’s GDP, making it the largest contributor to the Chinese economy.

What product is in high demand in China?

High-tech gadgets such as advanced smartphones, gaming consoles, and smart home appliances are currently in high demand in China. This trend is fueled by tech-savvy Gen Z and Millennials, who eagerly seek the latest innovations and cutting-edge technology.

Ready To Dominate The Chinese Market? Get In Touch With Us Today!

China is a very diverse and distinct market. While it’s tempting to enter top Chinese industries with many opportunities, you must remember that these perks come with fierce competition. You must be well-versed in consumer behaviors and ever-changing trends within the country’s fast-paced business landscape.

You may also want to read:

At Sekkei Digital Group, our team has the digital marketing expertise to help your brand reach the right audience. We possess enough industry experience to guide you in establishing a formidable authority in your niche.

Whether it’s creating an advertising campaign or launching a virtual storefront on e-commerce platforms, we have all the digital solutions you need. Contact us today, and let’s start working together!